Get Personal Loan in 24Hrs from Gpay

Google Pay (Gpay) offers personal loans in partnership with DMI Finance. The loan amount ranges from ₹10,000 to ₹50,000, with a repayment period of up to 36 months. The interest rate is 18% per annum. To be eligible for a Google Pay loan, you must:

- Be a resident of India

- Have a valid PAN card

- Have a savings account with a bank that is linked to your Google Pay account

- Have a credit score of at least 750

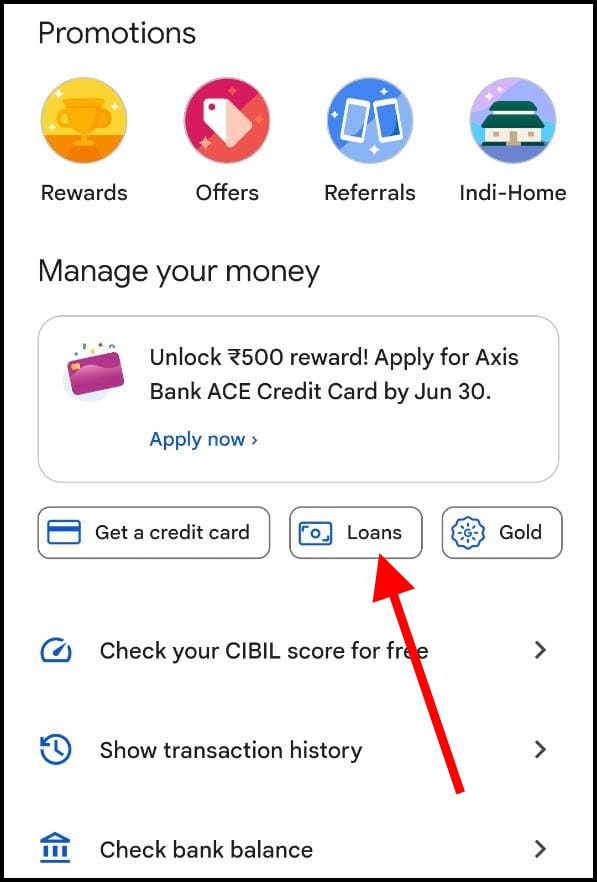

To apply for a Google Pay loan, open the Google Pay app and scroll down to “Loans” button, then click it.

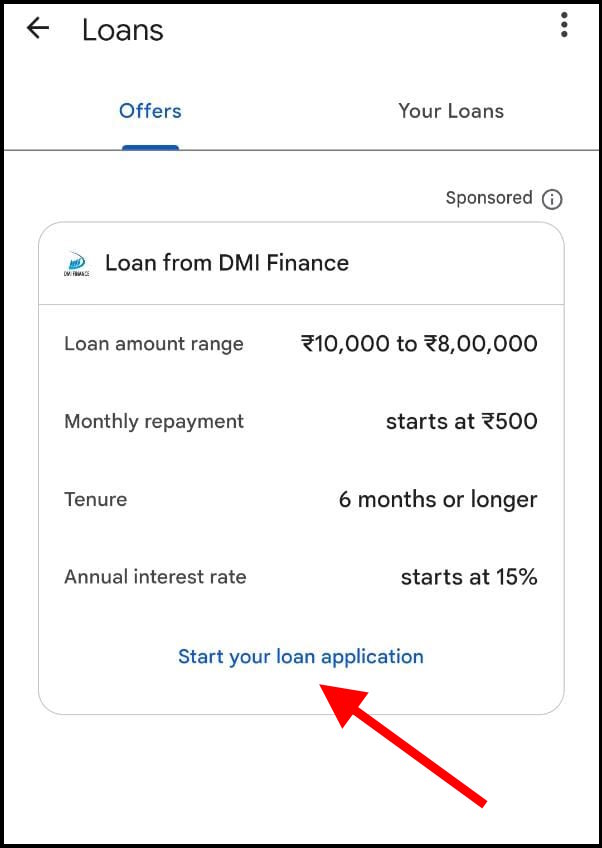

On next screen, click on Start your loan application

Further, you will be asked to provide some basic information, such as your name, email address, and contact number. You will also be asked to upload a copy of your PAN card and a recent bank statement. Once you have submitted your application, Google Pay will review it and will get back to you within 24 hours.

If your application is approved, you will receive the loan amount in your bank account within 24 hours. You will then have to repay the loan amount, along with interest, in monthly installments.

Here are some of the pros and cons of Google Pay loans:

Pros:

- Easy to apply for

- Quick approval

- Competitive interest rates

- Flexible repayment terms

Cons:

- High interest rates

- Short repayment period

- Not available to everyone

If you are looking for a personal loan, Google Pay is a good option to consider. However, it is important to compare different loan options before you apply, so that you can get the best deal possible.

Here are some other personal loan options that you may want to consider:

- Bank loans: Banks offer a variety of personal loans, with different interest rates and repayment terms.

- NBFC loans: Non-banking financial companies (NBFCs) also offer personal loans. NBFCs typically have higher interest rates than banks, but they may be more flexible in terms of repayment terms.

- Peer-to-peer lending: Peer-to-peer lending is a new type of lending where individuals lend money to each other. P2P lenders typically have lower interest rates than banks or NBFCs, but they may have stricter eligibility requirements.